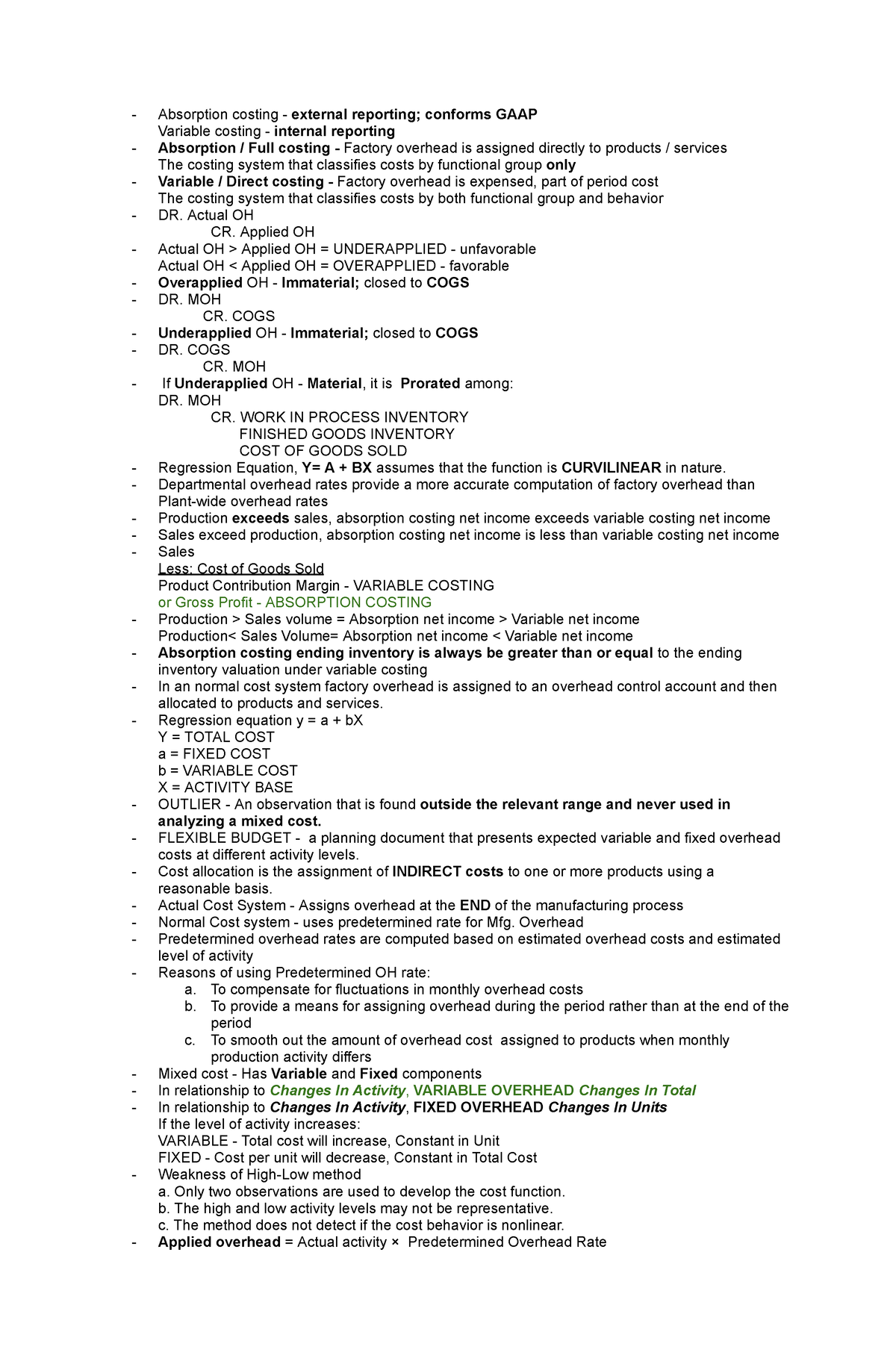

Therefore, variable costing is not permitted for external reporting. It is commonly used in managerial accounting and for internal decision-making purposes. Variable costing poorly upholds the matching principle, as related expenses are not recognized in the same period as related revenue.

Comparison of Costing Methods

Accurate financial reporting enhances transparency and trust among stakeholders, including investors, creditors, and regulators. Therefore, understanding the various costing methods and their implications is essential for maintaining the integrity of financial statements and achieving business success. Costing methods are integral to the preparation of financial statements under GAAP.

Standard Costing

Once the cost pools have been determined, the company can calculate the amount of usage based on activity measures. Direct labor hours is an example of an activity measure. This usage measure can be divided into the cost pools, creating a cost rate per unit of activity.

Role of Technology in Costing Method Implementation

GAAP is a set of detailed accounting guidelines and standards meant to ensure publicly traded U.S. companies are compiling and reporting clear and consistent financial information. Any company following GAAP procedures will produce a financial report comparable to other companies in the same industry. This provides investors, creditors and other interested parties an efficient way to investigate and evaluate a company or organization on a financial level. Under GAAP, even specific details such as tax preparation and asset or liability declarations are reported in a standardized manner. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records.

Why Variable Costing is not Permitted in External Reporting

- The integrated accounting system will calculate both cost components automatically so as to provide convenience to the accountant.

- As a result, when deciding whether to accept this special order, we should employ variable costing.

- The difference between the methods is attributable to the fixed overhead.

- Under absorption costing, the 2,000 units in ending inventory include the $1.20 per unit share, or $2,400 of fixed cost.

- The difference in the methods is that management will prefer one method over the other for internal decision-making purposes.

- It can be more useful, especially for management decision-making concerning break-even analysis to derive the number of product units that must be sold to reach profitability.

HashMicro is Singapore’s ERP solution provider with the most complete software suite for various industries, customizable to unique needs of any business. For most of you who may still be confused about choosing the suitable method for your business, the continuation of this article can add to your insight before making the appropriate choice. Access and download collection of free Templates to help power your productivity and performance. The more precise your allocation, the happier they are.

If the units are not sold, the costs will continue to be included in the costs of producing the units until they are sold. This treatment is based on the expense recognition principle, which is one of the cornerstones of accrual accounting and is why the absorption method self-employment tax 2020 follows GAAP. The principle states that expenses should be recognized in the period in which revenues are incurred. Including fixed overhead as a cost of the product ensures the fixed overhead is expensed (as part of cost of goods sold) when the sale is reported.

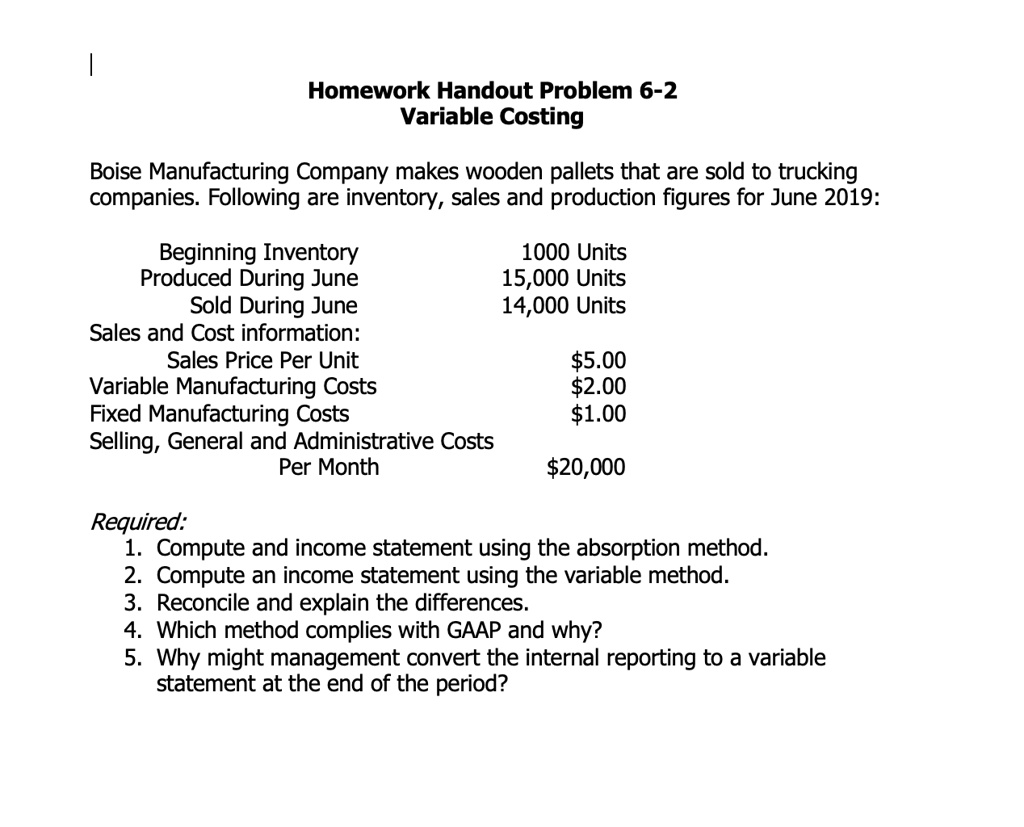

The following income statements present information about Nepal Company. On the left is the income statement prepared using the absorption costing method, and on the right is the same information using variable costing. For now, assume that Nepal sells all that it produces, resulting in no beginning or ending inventory. There are no uses for variable costing in financial reporting, since the accounting frameworks (such as GAAP and IFRS) require that overhead also be allocated to inventory.

They are obligated to acquire this information from the business, which is why an accounting team’s requests may seem intensely thorough when requesting financial information. When compiling reports, accountants must assume a business will continue to operate. The principle applies regardless of the status of the company. All negative and positive values on a financial statement, regardless of how they reflect upon the company, must be clearly reported by the accounting team. Accountants cannot try to make things look better by compensating a debt with an asset or an expense with revenue. We have been preparing income statements for manufacturers using this basic structure.